What Does Employee Retention Credits – It's Not Too Late! - CLA Blogs Mean?

9 Easy Facts About IRS Guidance on Employee Retention Credit Requires Described

Some companies, based upon internal revenue service guidance, normally do not fulfill this aspect test and would not qualify. Those thought about necessary, unless they have supply of vital material/goods interfered with in manner that affects their ability to continue to operate. Easy ERTC Tax Credit shuttered but able to continue their operations mostly undamaged through telework.

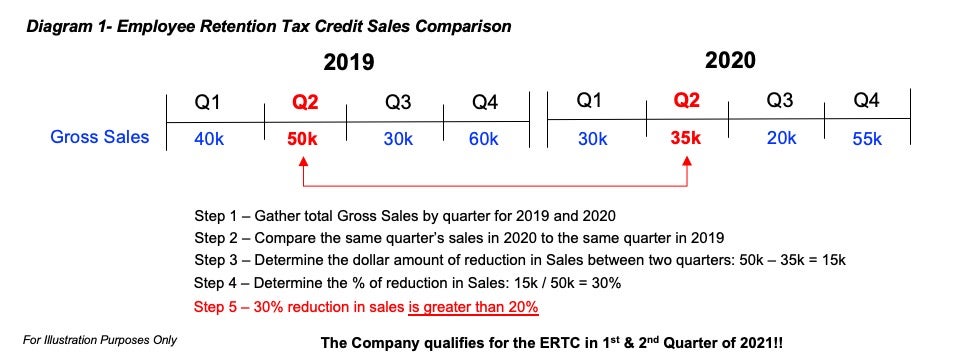

A company that has a significant decrease in gross receipts. On Tuesday, Aug. 10, 2021, the internal revenue service released Profits Treatment 2021-33 that offers a safe harbor under which a company may exclude the amount of the forgiveness of a PPP loan and the amount of a Shuttered Venue Operators Grant or a Restaurant Revitalization Fund grant from the definition of gross invoices solely for the purpose of identifying eligibility to claim the ERTC.

CARES Act 2020 Typically, if gross receipts in a calendar quarter are listed below 50% of gross receipts when compared to the same calendar quarter in 2019, an employer would certify. They are no longer eligible if in the calendar quarter instantly following their quarter gross receipts exceed 80% compared to the very same calendar quarter in 2019.

Employee Retention Tax Credit FAQ [Updated For 2022]

If you are a new business, the IRS allows the use of gross receipts for the quarter in which you started service as a reference for any quarter which they do not have 2019 figures due to the fact that you were not yet in business. American Rescue Plan Act 2021 In addition to eligibility requirements under the Consolidated Appropriations Act, 2021, organization also have the option of figuring out eligibility based on gross invoices in the instantly preceding calendar quarter (compared with the matching quarter in 2019).

Employee Retention Tax Credit on 941

Employee Retention Credit - Weaver Things To Know Before You Get This

Healing Startup Company American Rescue Strategy Act 2021 3rd and fourth quarter 2021 just a third category has actually been added. Those entities that certify may be entitled to up to $50,000 per quarter. To certify as a Healing Start-up Business, one need to: Have started continuing trade or company after Feb.

The employee retention credit is not calculating c

It must also be kept in mind that identifying if this category applies is evaluated for each quarter. So, if one of the other 2 classifications gross invoice decline or full/partial suspension applies to 3rd quarter but not 4th, they would not be a healing start-up in 3rd quarter, yet they may still certify as a healing startup in 4th quarter.